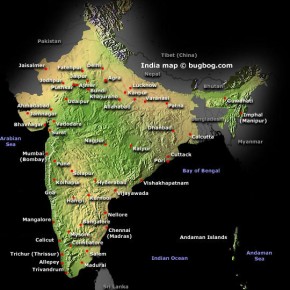

The Export-Import Bank of the United States (Ex-Im Bank) has authorized a pair of loans totaling $57.3 million to Solar Field Energy Two Private Ltd. and Mahindra Surya Prakash Private Ltd., respectively, to finance the export of American solar panels and ancillary services to India. The solar panels, which are manufactured by First Solar Inc. of Tempe, Ariz., will be used in the construction of solar photovoltaic plants in Rajasthan, India. These transactions will support 200 U.S. jobs at First Solar’s manufacturing facility in Perrysburg, Ohio.Solar Field Energy Two, a Mumbai-based company wholly owned by Kiran Energy Solar Private Power Ltd., has been approved for a $23 million loan from Ex-Im Bank for the construction of a 20-megawatt (MW) solar facility in Rajasthan. Mahindra Surya Prakash, also of Mumbai and owned by Kiran Energy and Mahindra Holding Ltd., has been approved for a $34.3 million Ex-Im loan to build two solar facilities (one 20 MW and one 10 MW) in Rajasthan as well.

The Export-Import Bank of the United States (Ex-Im Bank) has authorized a pair of loans totaling $57.3 million to Solar Field Energy Two Private Ltd. and Mahindra Surya Prakash Private Ltd., respectively, to finance the export of American solar panels and ancillary services to India. The solar panels, which are manufactured by First Solar Inc. of Tempe, Ariz., will be used in the construction of solar photovoltaic plants in Rajasthan, India. These transactions will support 200 U.S. jobs at First Solar’s manufacturing facility in Perrysburg, Ohio.Solar Field Energy Two, a Mumbai-based company wholly owned by Kiran Energy Solar Private Power Ltd., has been approved for a $23 million loan from Ex-Im Bank for the construction of a 20-megawatt (MW) solar facility in Rajasthan. Mahindra Surya Prakash, also of Mumbai and owned by Kiran Energy and Mahindra Holding Ltd., has been approved for a $34.3 million Ex-Im loan to build two solar facilities (one 20 MW and one 10 MW) in Rajasthan as well.

“These important transactions will finance the purchase of American products and services and support jobs in our innovative renewable-energy sector,” said Ex-Im Bank Chairman and President Fred P. Hochberg. “On top of that, Ex-Im’s financing will contribute to India’s drive to embrace clean-energy sources.”In 2010, the Indian government launched the Jawaharlal Nehru National Solar Mission in an effort to add 20,000 megawatts of installed solar capacity to the nationwide grid by 2020. According to a 2012 report in the Wall Street Journal, nearly 300 million people in India live without electricity.

India is one of Ex-Im Bank’s nine key markets and accounted for approximately $7 billion of the Bank’s worldwide credit exposure as of the end of FY 2011. In FY 2011 and FY 2012 to date, the Bank authorized more than $330 millionin financing for Indian solar projects. In FY 2012 to date, the Bank has authorized approximately $380 million for renewable-energy exports of all types worldwide.

Founded in 1999, First Solar is the world’s largest manufacturer of thin-film solar modules and has more than 1,900 employees in the United States, including 1,200 employees at its Perrysburg, Ohio, manufacturing and engineering center.

Nanosolar Raises $70 Million in New Capital

Nanosolar Inc. today announced that it has raised $70 million in new capital. The financing will be used to expand production of thin film solar cells and panels, support research and development designed to deliver greater efficiency, and drive faster commercialization of the company’s solar technology. The over-subscribed round was funded by current and new investors, including OnPoint Technologies, Inc., Mohr Davidow Ventures, and Ohana Holdings LLC, and international Family Offices.

Nanosolar Inc. today announced that it has raised $70 million in new capital. The financing will be used to expand production of thin film solar cells and panels, support research and development designed to deliver greater efficiency, and drive faster commercialization of the company’s solar technology. The over-subscribed round was funded by current and new investors, including OnPoint Technologies, Inc., Mohr Davidow Ventures, and Ohana Holdings LLC, and international Family Offices.

“We strongly believe in Nanosolar’s technology and the company’s ability to deliver the most cost-efficient solar electricity for utility scale and defense installations,” said John Trbovich, of Arsenal Venture Partners, the manager of OnPoint Technologies, Inc. “We are pleased to see the continued trust that our investors place in our company. The Family Offices that joined the round have a long-term view of the solar market and will help Nanosolar scale its business faster,” said Guido Polko, executive chairman of Nanosolar’s board of directors. “With this latest round of funding, Nanosolar will be able to continue ramping up its production capabilities and achieve a faster time-to-market with its products. The money also will allow us to deepen our R&D efforts aimed at achieving even greater efficiency, and significantly expand our employee base in both Europe and the United States.”

By printing CIGS inks on low-cost aluminum foil, Nanosolar is utilizing its proprietary high-throughput roll-to-roll printable semiconductor technology to enable the world’s lowest-cost thin-film solar panels. This approach minimizes the use of expensive, high vacuum manufacturing equipment, and enables Nanosolar solar cells and panels to reach efficiencies competitive with crystalline silicon panels. Nanosolar currently has manufacturing capacity in excess of 100 MW, with committed deliveries to multiple international customers in the 2 to 11 MW range. The company has achieved lab-tested top cell efficiency of 17.1 percent as certified by the National Renewable Energy Laboratory (NREL).

“Nanosolar has proven that it continues to effectively execute on its product roadmap and has established itself as a provider of world-class solar solutions,” said Eugenia Corrales, CEO of Nanosolar.

Goldman Intends to Enter Energy Sector With $40B Investment

Goldman Sachs Group, Inc. intends to channel investments accumulation $40 billion over the next ten years into renewable energy projects, an area the investment bank know one of the largest profit prospects since its economists got energized regarding emerging markets in 2001.

Goldman Sachs Group, Inc. intends to channel investments accumulation $40 billion over the next ten years into renewable energy projects, an area the investment bank know one of the largest profit prospects since its economists got energized regarding emerging markets in 2001.

Goldman administrators reported that demand for alternative energy sources will raise with global energy demand, and as big manufacturing countries, counting China and Brazil, set more aggressive targets for plummeting emissions. The bank intends to finance contracts with clients’ money and, to a lesser extent, its own funds. Read the article:

Powered by Innovation, CA Sets Accelerating Pace for U.S. in Clean Tech Race as State Cuts Emissions

State attracting lion’s share of venture capital & filing most patents

California’s lead in the global clean technology race is growing and that leadership is supporting the state’s economic rebound, while also driving California’s ability to cut emissions. These are among the findings of the 2012 California Green Innovation Index (www.next10.org), released today by the nonpartisan nonprofit group Next 10 and compiled by Collaborative Economics. The Index, the 4th since 2008, tracks the economic impacts of policies that help reduce state carbon emissions in California.

California’s lead in the global clean technology race is growing and that leadership is supporting the state’s economic rebound, while also driving California’s ability to cut emissions. These are among the findings of the 2012 California Green Innovation Index (www.next10.org), released today by the nonpartisan nonprofit group Next 10 and compiled by Collaborative Economics. The Index, the 4th since 2008, tracks the economic impacts of policies that help reduce state carbon emissions in California.

This latest edition finds that California is setting an accelerating pace for the United States in terms of venture capital (VC) investment, clean tech patent registration, energy productivity levels and renewable energy generation levels. From 2010 to 2011, clean tech investment in California rose by 24 percent to reach $3.5 billion, and clean tech patent registration increased by 41 percent from the period 2005-07 to 2008-10.

“VC investment and patent filings are two economic indicators that signal positive future growth in terms of jobs and businesses,” said F. Noel Perry, businessman and Founder of Next 10. “California’s commitment to an economy that is cleaner will also give us an economy that is stronger.”

The report also finds that renewable energy generation levels reached new heights in 2010, accounting for 13.7 percent of the state’s energy portfolio. This year, in the wake of the Solyndra bankruptcy, the Index examines the state’s solar industry in a special feature.

Key solar sector findings include:

• In 2011, the state earned 62 percent of total global VC investment in solar, representing $1.2 billion.

• 105 patents were registered in California in 2010 in solar and related processes—that represents a doubling of registrations since 2009.

• In 2011, California surpassed 1000 MW of installed solar capacity, putting the state among the top solar adopting countries in the world.

• From January 1995 – January 2010, 1,503 solar businesses were born in California, an increase of 171 percent.

• From January 1995 – January 2010, employment in the solar sector rose 166 percent with solar installation and contracting jobs representing the bulk new growth.

“Despite what we heard in the news this year, the data shows that Solyndra’s story is not the story of solar in California,” said Perry. “California’s solar industry is recording significant growth and innovation that is being driven by our world class entrepreneurs, savvy population of early adopters and our forward-looking policies.”

Other key findings of the 2012 Index include:

• California leads the nation in clean tech patent registrations, filing 910 between 2008-2010. Solar and battery patents represent 41 percent (182 patents) and 21 percent (258 patents) respectively of all clean tech patents filed nationwide.

• From 2009 to 2010, energy generation from renewable sources in California increased 11.2 percent to represent 13.7 percent of all energy generated in the state.

• California’s wind generation capacity jumped by 44 percent from 2009 to 2010.

• For every dollar of GDP generated in 2009, California emitted 28 percent less carbon than in 1990.

• Due to energy efficiency efforts, per capita electricity consumption in California remains close to 1990 levels.

• Energy productivity, measured as the ratio of energy consumed (inputs) to GDP (economic output), is 64 percent higher in California than in the rest of the country. Because of this higher rate of efficiency, California produces $2.35 of GDP for every 10,000 British Thermal Units (BTU) of energy consumed. The rest of the U.S. produces $1.43 of GDP for every 10,000 BTU of energy consumed.

“California was a first adopter of energy efficiency and carbon emission reduction measures, and our state continues to be a clean tech innovator. By setting the market rather than chasing it, today California’s leadership is paying off in the form of investment, innovation, and growth,” said Doug Henton, Chairman and Chief Executive Officer of Collaborative Economics and author of the report.

President Obama on New Jobs Act

U.S. Tech Giants Become Alternative Energy’s Fairy Godfathers

While the failure of government-backed solar start-up Solyndra generated a lot of news headlines, it has also encouraged some discussion about the role of government in helping get new industries off the ground. It may also have highlighted the fact that venture capital companies and their investors may be starting to fall out of love with alternative energy, an industry that has proven it needs a long runway for take-off. Venture capitalists and investors, not always the most patient of people, seem to be increasingly wary about investing in technologies that are still in their infancy, or at least in their youth.

While the failure of government-backed solar start-up Solyndra generated a lot of news headlines, it has also encouraged some discussion about the role of government in helping get new industries off the ground. It may also have highlighted the fact that venture capital companies and their investors may be starting to fall out of love with alternative energy, an industry that has proven it needs a long runway for take-off. Venture capitalists and investors, not always the most patient of people, seem to be increasingly wary about investing in technologies that are still in their infancy, or at least in their youth.

But as the news last week brought us the knowledge that the seven billionth human being entered the world somewhere in India, the need to move forward with alternative energy remains urgent. And move forward it will: though it may not find itself using government cash or traditional venture capital to do so. But before we talk about that: it’s appropriate to talk about two bright spots in alternative energy that have something in common.

In the Mojave Desert, 40 miles southwest of Las Vegas and straddling the California/Nevada border, a new kind of solar facility is under construction on 3,600 acres of federal-owned land. It’s a a $2.2 billion solar thermal power plant being built by BrightSource Energy. The facility, called the Ivanpah Solar Electric Generating System, is different from a standard solar array. The site, once completed, will feature arrays of mirror-like devices called “heliostats” that concentrate the sun’s rays onto 459-foot tall “power towers,” using the energy to boil water to create steam. The steam is then used to drive a turbine that generates electricity. The Ivanpah will ultimately consist of three separate power plants, each featuring a power tower and thousands of heliostats: about 173,500 in total. Read the full article:news.thomasnet.com-US_Tech_Giants_Become_Alternative_Energys_Fairy_Godfathers

Leading Bioplastics Producer, to Expand its Green Business Portfolio

PTT Chemical announced today that it is collaborating with Cargill to form a 50/50 joint venture by investing $US150 million in NatureWorks LLC, the world’s leading bioplastics manufacturer and supplier of its broad family of renewable Ingeo(TM) biopolymers made from plants to plastics and fibers markets worldwide.

PTT Chemical announced today that it is collaborating with Cargill to form a 50/50 joint venture by investing $US150 million in NatureWorks LLC, the world’s leading bioplastics manufacturer and supplier of its broad family of renewable Ingeo(TM) biopolymers made from plants to plastics and fibers markets worldwide.

“The Thai Government encourages an investment in Green Chemicals, and particularly bioplastics which have high growth potential in the South East Asian market” said Thailand’s Minister of Energy, H.E. Mr. Pichai Naripthaphan. “PTT Chemical has made a significant step in achieving Thailand’s strategic objectives of becoming a regional hub for green technologies and solutions.”

“This is a significant investment by a leading chemical company which will allow NatureWorks to continue its aggressive growth while expanding its capacity to meet global demand for bio-based products. PTT Chemical’s investment demonstrates a significant milestone in moving Ingeo bio-based plastics & fibers to the polymer mainstream,” said Marc Verbruggen, president and chief executive officer of NatureWorks. “PTT Chemical’s investment supports NatureWorks intent to globalize its Ingeo manufacturing capability by building a new production facility in Thailand, supporting our Asian customer base, and delivering on our commitment to renewable feedstock diversification. We anticipate bringing the new plant online in 2015 and expect to announce further details on this expansion later this year. Full article: Leading Bioplastics Producer, to Expand its Green Business Portfolio

New Resource Bank, Adam Capital Join Forces to Fill Critical Solar Funding Gap

$3M line of credit will help small-scale renewable energy developers bridge the construction funding gap

New Resource Bank (OTCBB:NWBN) has approved a $3 million line of credit for Adam Capital Clean Energy Asset Finance LLC. The funding will allow the solar energy finance firm to extend additional capital to small-scale solar developers throughout the United States, including home owners, small businesses, nonprofits, schools and low-income housing developments.

New Resource Bank (OTCBB:NWBN) has approved a $3 million line of credit for Adam Capital Clean Energy Asset Finance LLC. The funding will allow the solar energy finance firm to extend additional capital to small-scale solar developers throughout the United States, including home owners, small businesses, nonprofits, schools and low-income housing developments.

Adam Capital pioneered asset-based lending for rooftop-scale clean energy developers and has funded hundreds of completed projects with loans in the $500,000 to $5 million range. By providing loans to cover up-front construction and installation costs, Adam Capital enables developers to install solar energy systems that qualify for federal government ITC Grant funds as well as local utility rebates and incentives. Grants, rebates and incentives are directly assigned to Adam Capital to repay the short-term loans.

Adam Capital currently serves 400 to 600 solar projects per month. Backed by New Resource, the firm will be able to fund more projects and developers — and bring the benefits of solar energy to more people — in this underserved market sector, where projects often stall for lack of financing.

“We’re excited to be growing our relationship with Adam Capital,” says Joe Anzalone, New Resource chief banking officer. “As a mission-focused bank with the goal of advancing sustainability and renewable energy, we view Adam Capital and its ability to provide financing to clean energy developers as invaluable. Few private lending institutions have the expertise necessary to provide funding for residential- and small business–scale installations. Given our shared vision for distributed power generation and our shared philosophy to promote sustainable living, we see a great future in our relationship.”

Adam Boucher, founder and CEO of Adam Capital, says: “This line of credit from New Resource Bank demonstrates that Adam Capital has developed lending products, systems and controls that enable us to serve an overlooked market with a level of oversight unparalleled in the marketplace today. Combining our specific expertise in this space with the institutional resources of New Resource Bank allows us to expand our capacity. This relationship will allow us to fund hundreds more projects than we otherwise would have by the end of the year.”

Sunny Day For Solar Stocks Despite Mixed Analysts Views

Shares of Chinese solar firm Yingli Green Energy Hldng (YGE) are off half a percent despite being on the receiving end of some positive comments from Brean Murray, which spoke out on several solar names today. The research firm raised its rating on Yingli Green to “buy” from “hold” with a $10 price target, which represents significant upside from where the shares currently trade. Brean Murray said margin erosion should be fully baked into Yingli Green’s shares and that the solar sector should see improved demand in the second half of the year.

Shares of Chinese solar firm Yingli Green Energy Hldng (YGE) are off half a percent despite being on the receiving end of some positive comments from Brean Murray, which spoke out on several solar names today. The research firm raised its rating on Yingli Green to “buy” from “hold” with a $10 price target, which represents significant upside from where the shares currently trade. Brean Murray said margin erosion should be fully baked into Yingli Green’s shares and that the solar sector should see improved demand in the second half of the year.

That’s music to the ears of solar investors as the Solar Stocks Index is up 1.2%. Brean Murray was not so kind with JA Solar Holdings (JASO). That stock is down 4% after Brean Murray downgraded it to “sell” with a $4 price target, which is well below where the shares currently trade. The research firm said materials prices are pressuring JA Solar’s margins and that the company is less of a candidate to participate in a second-half demand rebound.

Shares of ReneSola (SOL) are down 2% after Brean Murray downgraded that name to “hold” from “buy” citing expectations for second-half margin erosion at the hands of material wafer weakness and limited prospects for a second-half rebound.

Shares of First Solar (FSLR), the largest U.S. solar company, are surging 5% despite Jefferies saying the company may lower its fiscal 2011 guidance when it reports second-quarter earnings. Jefferies reiterated a “hold” rating on First Solar, but trimmed its price target on the stock to $133 from $145, noting the shares may have more upside than downside after expectations are adjusted.

GT Solar International (SOLR), SunPower (SPWRA) and Trina Solar (TSL) are all higher by 2% today. Source: TickerSpy

Niche outlook becomes way of life

Fund Strategy – 6 June 2011 | By Shaun Cumming: The manager of the Jupiter Green investment trust is keen to exploit the increased appetite for environmental products and services, including a waste management firm operating in Scotland.

Fund Strategy – 6 June 2011 | By Shaun Cumming: The manager of the Jupiter Green investment trust is keen to exploit the increased appetite for environmental products and services, including a waste management firm operating in Scotland.

Charlie Thomas, the manager of the Green investment trust and head of environmental investment at Jupiter, has a passion for green investment which spills over to his leisure time. At the weekend he tends beehives from which he harvests honey. He also has solar panels on the roof of his home.

Thomas has noticed a change in the way environmental investing is developing. He is implementing changes to the two funds he manages to adapt to the evolving sector.

The Green investment trust has run for many years using six themes under which investments are categorised, which are also in place on Jupiter’s other environmental vehicle, the Ecology fund. These are being reduced to three global themes which Thomas says better reflect the changing environment the sector is facing: resource efficiency, infrastructure and demographics. Read the full article: Niche outlook becomes way of life

More Green Investing