How to Invest in Solar Stock

The $50 Billion $olar Market

Solar stocks are a big trend these days, as more companies develop technologies that use the heat and light of the sun to generate power. Renewable solar power is becoming more important as the prices of oil and natural gas continue to rise. Also, many people are concerned about the health risk and environmental risks of nuclear power and coal-burning power plants. As people look for alternative energy sources, solar companies are emerging and gaining in popularity. While investing in solar stocks is a good idea, investing in solid companies is an even better one.

Step 1

Educate yourself about solar technology. Investing in solar stocks involves understanding how solar power is used. As an emerging technology, there will be solar companies devoted to sound business principles, while others are just following the current trend. To choose the best solar stocks, understand what a company does and how its products or services will impact the solar power industry. Learn as much as you can about the various types of solar technologies available and what the energy experts are saying. Read industry publications like “Green Chip Stocks.”

Step 2

Decide on a trading strategy. Before you start buying solar stocks, you need to have a trading plan in place. If you are a conservative investor, you may want to buy a good stock and hold it long term, for a year or more. Many solar stocks are of new companies so there is more inherent risk in them, especially in the short term.

Step 3

Choose stocks with good value. Solar companies with steady earnings and low debt are good signs of a well-run company. With all solar companies, research and development is an integral part of the company’s future. Innovative technology will make a solar company distinctive. A solar company needs to have enough capital to fund its R&D department, so look for companies with an influx of capital from venture capitalists. This information will be in its financial statements. This is a good sign that the company will have the financial backing it needs to grow into a large and profitable company.

Step 4

Practice trading stocks. The old-fashioned way was to paper trade. With this method, you chose stocks and monitored their progress on paper. But now you can trade online by playing stock-investing games. In most cases, you are given at least $10,000 in virtual money to trade stocks with. The game keeps track of the stocks in your virtual portfolio, as well as your profits and losses. There are no online trading games especially for the solar energy market, but solar stocks, especially those of large companies, will be listed in these games.

Step 5

Find a broker that suits your needs. There are full-service brokers like Morgan Stanley and online brokers like E*Trade. Both execute your trades, but the minimum initial deposits and the commission rates vary sharply. All stockbrokers deal with stocks of any industry, so you should have no problems buying and selling solar stocks with the broker you choose.

Step 6

Start by buying one stock. If you are new to investing, it is probably best to start small and buy shares in one solar company. Buying stocks in a company that manufactures solar panels is a good start because this industry has been around a long time and has proven itself to be an effective product that is growing in popularity. As you gain more confidence in your investing skills, add more stocks. But remember to diversify your portfolio. It is not a good idea to only invest in solar stocks. If the solar industry has a downturn, your entire portfolio could decrease in value. Solar stocks of good companies can make you money, but they should be just a small percentage of your investments.

Just Energy Hits $40 Million In Green Energy Investment

Mississauga, Ontario, Just Energy, a leading North American natural gas and electricity retailer, has announced that its investments in green projects in Canada and the United States now total $40 million, making it one of the largest green energy providers on the continent.

The company’s investments in renewable energy credits and carbon offsets provide eco-conscious residential and commercial consumers with immediate solutions to help reduce the harmful carbon emissions associated with their household or business energy consumption.

On behalf of its customers, Just Energy purchases renewable energy credits and carbon offsets from certified sources for greenhouse gas reduction and green energy production matched to offset its customers’ average electricity and/or natural gas use.

“Customers that subscribe to our green energy programs join a growing community of environmentally responsible energy consumers who are taking action to reduce their environmental footprint” says Ken Hartwick, Just Energy’s President and Chief Executive Officer. “Whenever possible, we pursue renewable energy and carbon offset projects located within the communities we serve. Such customer participation supports the continued development of large scale carbon reduction and renewable energy projects in communities across North America.”

The company’s JustGreen™Power and JustGreen™Natural Gas products allow residential and commercial customers to select green energy options as a complement to their electricity or natural gas contract. In markets where JustClean™Home is available, residential consumers can go green without enrolling in the company’s natural gas or electricity supply program and still offset up to 100% of the carbon emissions caused by their everyday energy use.

Just Energy’s programs have helped its customers offset carbon emissions equivalent to taking 69,300 passenger vehicles off the road for an entire year and have injected enough renewable power into the electricity grid to power 160,000 homes for a year.

“And we will continue to make further local investments to meet growing customer demand for green and renewable energy,” says Ken Hartwick.

As a measure of accountability Just Energy’s green purchases are reviewed yearly by an international independent third party accounting firm, which confirms that money spent by customers goes directly to renewable energy or carbon offset projects.

Visit justenergy.com and justcleancommunity.com to learn more about the company’s green programs, and the measurable differences that energy consumers can make towards a healthier, greener environment every day. About Just Energy:

Just Energy is a leading North American electricity and natural gas retailer. Through its affiliates under its parent, Just Energy Group Inc, a publicly traded corporation (TSX: JE), Just Energy serves 1.8 million residential and commercial customers, helping them gain better control of their energy costs. In addition, through National Home Services, Just Energy sells and rents high efficiency and tankless water heaters, and through its subsidiary Terra Grain Fuels, produces and sells wheat-based ethanol. Just Energy is an industry leader in providing environmentally responsible energy options to consumers across North America. To learn more about Just Energy visit www.justenergy.com SOURCE Just Energy

Wells Fargo to Fund $120 Million in U.S. Solar Projects Developed by SunEdison

SAN FRANCISCO: Wells Fargo & Company and SunEdison LLC, a subsidiary of MEMC Electronic Materials, today announced an agreement by which Wells Fargo subsidiaries will invest up to $120 million to fund U.S. solar photovoltaic distributed generation power projects developed by SunEdison over the next year. The program builds on a SunEdison solar investment fund established in 2007 in which Wells Fargo invested more than $200 million in approximately 150 solar projects developed by SunEdison in eight states.

SAN FRANCISCO: Wells Fargo & Company and SunEdison LLC, a subsidiary of MEMC Electronic Materials, today announced an agreement by which Wells Fargo subsidiaries will invest up to $120 million to fund U.S. solar photovoltaic distributed generation power projects developed by SunEdison over the next year. The program builds on a SunEdison solar investment fund established in 2007 in which Wells Fargo invested more than $200 million in approximately 150 solar projects developed by SunEdison in eight states.

“Wells Fargo is excited to continue our relationship with SunEdison and expand our commitment to grow the U.S. solar market,” said Barry Neal, head of Wells Fargo’s Environmental Finance Group. “The solar projects developed by SunEdison will help businesses and public entities better control their electricity costs, while expanding the use of renewable energy throughout the U.S.”

Financing provided by Wells Fargo will enable SunEdison to cost-effectively provide a clean and reliable source of electricity to its customers, including corporations and municipalities. Under the power purchase agreement (PPA) model, SunEdison builds, manages, and operates the solar systems while its customers buy the energy produced at prices at or below retail rates. This allows customers to avoid upfront costs typically associated with solar projects.

“SunEdison makes investing in solar a smart choice,” said Chris Bailey, SunEdison vice president of Project Finance, North America. “SunEdison has the experience and know-how that project investors and customers trust. SunEdison looks forward to growing its relationship with Wells Fargo as we continue to make solar a reality for our customers across the nation.”

SunEdison, a leading worldwide solar energy services provider, has deployed over 400 solar projects totaling over 160MW in North America, and has developed over 100MW outside of North America.

Wells Fargo has provided more than $2 billion in tax equity financing for renewable energy projects since 2006, including funding for 30 wind projects, over 200 commercial-scale solar projects and one utility-scale solar thermal project.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a nationwide, diversified, community-based financial services company with $1.2 trillion in assets. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, insurance, investments, mortgage, and consumer and commercial finance through more than 9,000 stores, 12,000 ATMs, the Internet (wellsfargo.com and wachovia.com), and other distribution channels across North America and internationally. With approximately 280,000 team members, Wells Fargo serves one in three households in America. Wells Fargo & Company was ranked No. 19 on Fortune’s 2010 rankings of America’s largest corporations. Wells Fargo’s vision is to satisfy all our customers’ financial needs and help them succeed financially.

About SunEdison

SunEdison is a global provider of solar-energy services. The company develops, finances, installs and operates distributed power plants using proven photovoltaic technologies, delivering fully managed, predictably priced solar energy services for its commercial, government, utility and residential customers. In 2010 SunEdison deployed more than 160 Megawatts of solar throughout the world. For more information about SunEdison, please visit www.sunedison.com.

About MEMC

MEMC is a global leader in semiconductor and solar technology. MEMC has been a pioneer in the design and development of silicon wafer technologies for 50 years. With R&D and manufacturing facilities in the U.S., Europe, and Asia, MEMC enables the next generation of high performance semiconductor devices and solar cells. Through its SunEdison subsidiary, MEMC is also a developer of solar power projects and a worldwide leader in solar energy services. MEMC’s common stock is listed on the New York Stock Exchange under the symbol “WFR” and is included in the S&P 500 Index. For more information about MEMC, please visit www.memc.com

New Energy Releases Power Production Estimates & Commercial Targets for its Novel Technologies

COLUMBIA, Md. New Energy Technologies, Inc. (OTCQB: NENE) today provided important product performance and target market goals, key to the ongoing commercialization efforts of its SolarWindow™ and MotionPower™ technologies. The Company’s technologies are the subject of 24 patent filings. SolarWindow™ and MotionPower™ are under development as distributed second generation systems for the generation of sustainable clean energy at or near customers’ point of electricity consumption. Calculated energy production and electricity output estimates, and specific commercial target markets and product goals for both technologies were made available today in an updated Company Overview (see attached).

COLUMBIA, Md. New Energy Technologies, Inc. (OTCQB: NENE) today provided important product performance and target market goals, key to the ongoing commercialization efforts of its SolarWindow™ and MotionPower™ technologies. The Company’s technologies are the subject of 24 patent filings. SolarWindow™ and MotionPower™ are under development as distributed second generation systems for the generation of sustainable clean energy at or near customers’ point of electricity consumption. Calculated energy production and electricity output estimates, and specific commercial target markets and product goals for both technologies were made available today in an updated Company Overview (see attached).

SolarWindow™ is capable of generating electricity on see-thru glass, and is currently under development for commercial, structural, architectural, and residential glass products. New Energy’s MotionPower™ systems capture available kinetic energy from vehicles at points where these vehicles are required to slow down or come to a stop and creatively converts this kinetic energy into electricity, thus ensuring that moving vehicles are not ‘robbed’ of energy and fuel otherwise required for acceleration.

John A. Conklin, the Company’s President and Chief Executive Officer, noted that, “We are pleased to provide our stockholders and the investing public with this important Company Overview, which contains product goals and information that elaborates on our commitment to achieving important and strategic initiatives towards corporate and product development.”

About New Energy Technologies, Inc.

New Energy Technologies, Inc., together with its wholly owned subsidiaries, is a developer of next generation alternative and renewable energy technologies. Among the Company’s technologies under development are:

• MotionPower™ roadway systems for generating electricity by capturing the kinetic energy produced by moving vehicles – a patent-pending technology, the subject of nine patent applications in the United States and two international patent filings. An estimated 250 million registered vehicles drive more than six billion miles on America’s roadways, every day; and

• SolarWindow™ technologies which enable see-thru windows to generate electricity by ‘spraying’ their glass surfaces with New Energy’s electricity-generating coatings. These solar coatings are less than 1/10th the thickness of ‘thin’ films and make use of the world’s smallest functional solar cells, shown to successfully produce electricity in a published peer-reviewed study in the Journal of Renewable and Sustainable Energy of the American Institute of Physics.

Through established relationships with universities, research institutions, and commercial partners, we strive to identify technologies and business opportunities on the leading edge of renewable energy innovation. Unique to our business model is the use of established research infrastructure owned by the various institutions we deal with, saving us significant capital which would otherwise be required for such costs as land and building acquisition, equipment and capital equipment purchases, and other startup expenses. As a result, we are able to benefit from leading edge research while employing significantly less capital than co

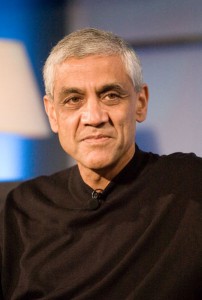

Wipro’s Azim Premji parks $15 million in Vinod Khosla’s clean-tech fund

BANGALORE: In his first ever investment overseas, Wipro’s billionaire chairman Azim Premji has invested around $15 million in Vinod Khosla’s clean-tech fund in the US, the biggest such fund focused on returns from Silicon Valley’s hottest start-ups.

BANGALORE: In his first ever investment overseas, Wipro’s billionaire chairman Azim Premji has invested around $15 million in Vinod Khosla’s clean-tech fund in the US, the biggest such fund focused on returns from Silicon Valley’s hottest start-ups.

With nearly $1.5 billion corpus, Premji Invest, the investment arm that manages the Wipro founder’s wealth, now plans to look beyond India for diversifying its portfolio and also tap into lucrative opportunities offered by new technology companies in the US.

“Risk appetites are higher in the valley, and so are returns if you are betting with somebody like Khosla,” said a Valley-based investor familiar with the development. “We are bound to see an increased interest from Indian investors in outbound opportunities,” he added.

Another person, aware of a non-disclosure agreement signed between Khosla Ventures and Premji Invest, said the transaction took place some four months ago.

Khosla’s green fund investments range from cellulosic ethanol firm Range Fuels and LS9 that designs microbes to produce biofuels.

In 2009, Khosla Ventures raised nearly $1.1 billion for two funds focussed on green technology and information technology start ups.

So far, he has invested in over 40 clean-tech companies including bio fuel projects such as KiOR and Amyris and Gevo.

Microsoft founder Bill Gates and several other big names from the technology world are backing Khosla’s green fund.

VC Investments in Clean-Tech on the Rise

Officials at Khosla Ventures did not respond to an email query sent by ET and Premji Invest declined to offer any comments.

Venture capital investments in clean tech have been rising in the US, attracting billionaires such as Premji and others. Last year VC investment in US clean tech firms rose 46% to $5.1 billion, according to research firm Clean Edge. Clean tech revenues, which includes sale of biofuels, wind power and solar equipments is expected to become $349.2 billion industry in 2020 from around $188.1 billion 2010, the research firm added.

Although small, Premji’s first overseas investment marks a shift in his investment strategy that has so far been primarily about Wipro (79% stake), apart from smaller investments in Manipal Education among others.

“He seems to be testing the waters, geographic de-risking and possible high returns from new technologies are among drivers,” said a financial investor who is familiar with Premji’s other investments. Indeed, given the scale of philanthropic activities and other commitments Premji has already undertaken, his corpus needs to ensure a well diversified portfolio beyond geographies and investment areas.

At times faced with scepticism, clean energy firms continue to attract investors from across the globe to the US. On his part, two of Khosla Venture’s green investments’ Amyris and Gevo have gone public and investors are not really complaining. However, some are raising concerns on whether these IPOs are being hurried and the prospects for such clean-tech start ups.

Some others say much of the clean tech talk is built around ‘ideology’ and not necessarily a business case. Khosla himself has said several times that costs alone will drive the clean technology industry and not the initial hype established by researchers.

The biggest challenge facing the industry is that some of the clean tech breakthroughs can take much longer before becoming commercially viable, and ultimately the cost comes out to be much higher. For instance, KR Sridhar’s famous Bloom Energy – the hottest clean tech start up in the valley – still faces questions about whether fuel cells can be used to generate electricity in a reliable fashion, and most importantly at prices that compete with conventional energy.

“Start-ups like KiOR are far from being an established business with clear revenue stream,” said a senior executive at one of the India-based investing firms who has been evaluating the clean tech sector. On his part, Premji is known for his interest in clean technology. He established EcoEnergy-a unit focussed on clean tech.

More Green Investing