A subsidiary of U.S. Bancorp today announced the creation of a new renewable energy tax equity fund with Sunrun to support the purchase and installation of more than $150 million in residential solar systems across the United States. Sunrun is a market leader in home solar and this is the company’s sixth renewable energy tax equity commitment from U.S. Bancorp.“U.S. Bancorp has been our trusted partner for years and is instrumental to Sunrun’s continued success as one of the largest providers of clean, affordable solar energy for American families,” said Sunrun co-Founder and CEO Edward Fenster.Through its substantial tax equity commitments, U.S. Bancorp has helped Sunrun bring affordable solar to thousands of homes across the country.

A subsidiary of U.S. Bancorp today announced the creation of a new renewable energy tax equity fund with Sunrun to support the purchase and installation of more than $150 million in residential solar systems across the United States. Sunrun is a market leader in home solar and this is the company’s sixth renewable energy tax equity commitment from U.S. Bancorp.“U.S. Bancorp has been our trusted partner for years and is instrumental to Sunrun’s continued success as one of the largest providers of clean, affordable solar energy for American families,” said Sunrun co-Founder and CEO Edward Fenster.Through its substantial tax equity commitments, U.S. Bancorp has helped Sunrun bring affordable solar to thousands of homes across the country.

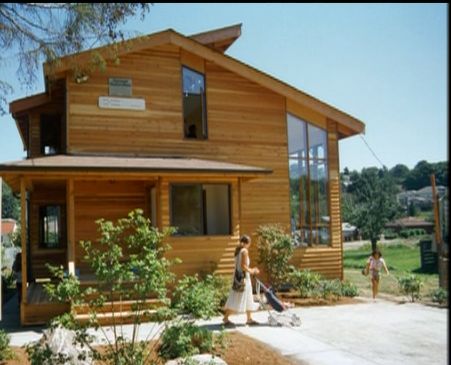

Sunrun came into the market in 2007 as a way for homeowners to go solar without high upfront costs. Sunrun owns, insures, monitors and maintains the solar panels on a homeowner’s roof, while families pay a low rate for clean energy and fix their electric costs for 20 years. Typical Sunrun customers pay a lower rate for solar energy than what they pay for electricity from their utility companies. Sunrun installs over $1.5 million in solar every day and has more than 20,000 customers in ten states.

A recent report from Sunrun and PV Solar Report, an authority on solar market data, shows solar power service is becoming the preferred way for homeowners to go solar. For example, solar power service grew 174 percent in California in the first two months of 2012 compared to the first two months of 2011. It has generated over $100 million in growth for the California economy so far in 2012. One in every three California homeowners who installs solar does so with Sunrun.