Congresswoman Eddie Bernice Johnson of Texas has backed legislation that will make significant new investments in renewable energy sources, create hundreds of thousands of new jobs, help end our dependence on foreign oil and slash taxpayer funded subsidies to oil companies. The Renewable Energy and Energy Conservation Tax Act of 2008 was approved by a vote of 236-182 on February 27th.“With oil prices reaching another record high of $102 per barrel today and families paying $3.15 a gallon for gasoline, the time for action on renewable energy and American energy independence is now. This bill is good for our environment, good for our economy and good for our national security,” said Congresswoman Johnson. “Ending our dependence on foreign oil and using renewable energy to help fight global warming will make our nation stronger. And at a time when our economy is struggling, these investments will help create hundreds of thousands of new jobs. ”

Congresswoman Eddie Bernice Johnson of Texas has backed legislation that will make significant new investments in renewable energy sources, create hundreds of thousands of new jobs, help end our dependence on foreign oil and slash taxpayer funded subsidies to oil companies. The Renewable Energy and Energy Conservation Tax Act of 2008 was approved by a vote of 236-182 on February 27th.“With oil prices reaching another record high of $102 per barrel today and families paying $3.15 a gallon for gasoline, the time for action on renewable energy and American energy independence is now. This bill is good for our environment, good for our economy and good for our national security,” said Congresswoman Johnson. “Ending our dependence on foreign oil and using renewable energy to help fight global warming will make our nation stronger. And at a time when our economy is struggling, these investments will help create hundreds of thousands of new jobs. ”

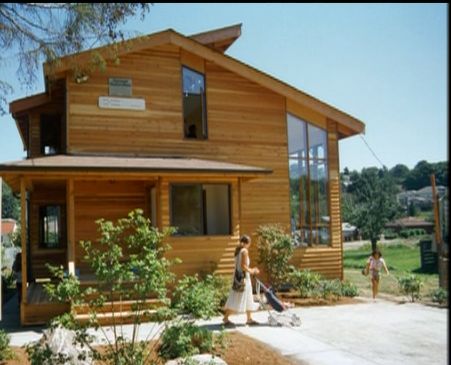

The Renewable Energy and Energy Conservation Tax Act extends and expands tax incentives for renewable electricity, energy and fuel, as well as for plug-in hybrid cars, and energy efficient homes, buildings, and appliances. Additionally, the bill includes solar energy tax credits that could reduce carbon dioxide pollution by 240 million tons.The new investments in wind, solar, geothermal and fuel cell technology will also create hundreds of thousands of new jobs and help strengthen the American economy. The Geothermal Energy Association estimates that the geothermal provisions alone could create tens of thousands of new jobs and stimulate tens of billions of dollars of new investment in geothermal energy production.

Additionally, the legislation approved today repeals $18 billion in unnecessary tax subsidies for big, multinational oil and gas companies. The vote comes shortly after the big five oil companies recently reported record profits for 2007. While oil companies have profited, consumers have felt the pinch. The average cost of a gallon of gasoline in Dallas is $3.058. A year ago it was $2.61 a gallon. H.R. 5351 includes more than $8 billion in long-term clean renewable energy tax incentives for electricity produced from renewable resources, including wind, solar, geothermal, biomass, hydropower, ocean tides, and landfill gas and $2 billion in new clean renewable energy bonds for electric cooperatives and public power providers to finance facilities that generate electricity from these renewable resources.